Language:

Daily summary of financings for therapeutic biotechnology company executives and investors

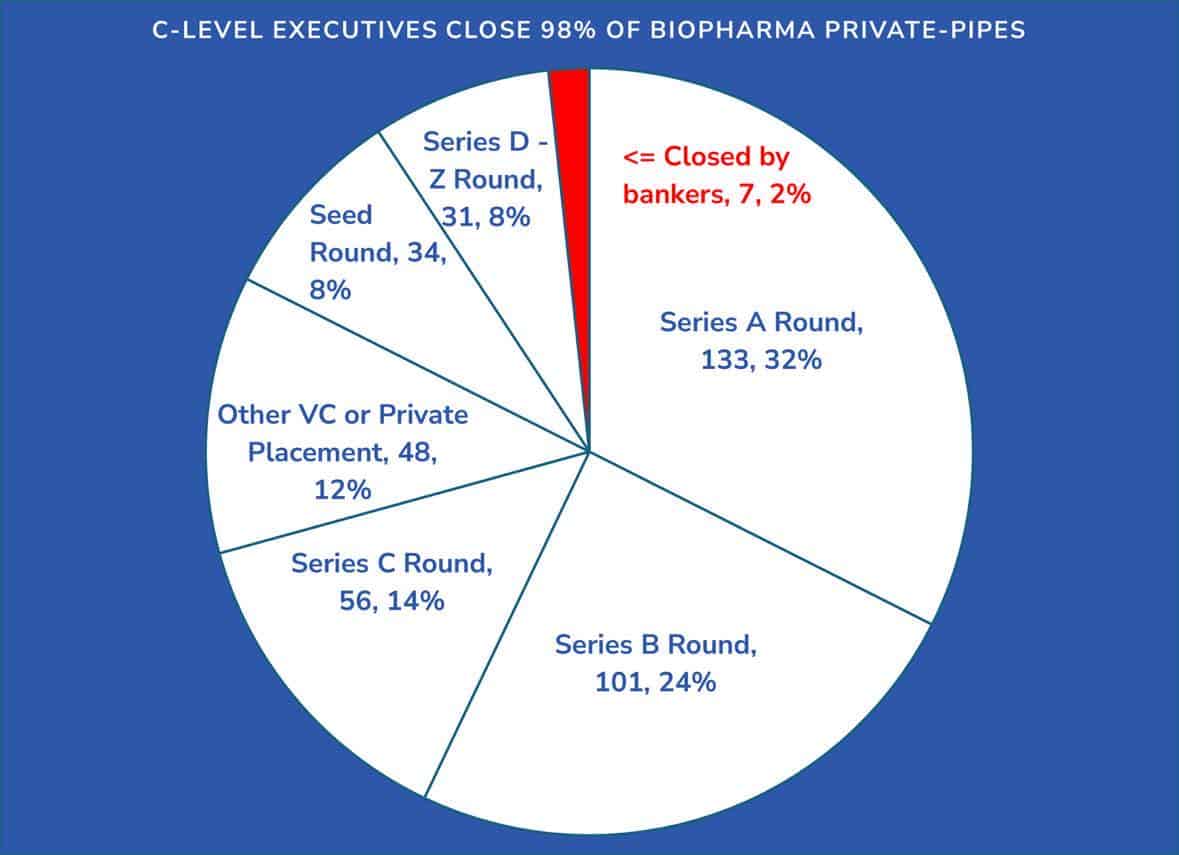

Biopharma Boards Count on Executives—Not Bankers—for Private-PIPE Financing Success Collabrity Analysis

VANCOUVER, BC — July 2025

Chart: Distribution of Biopharma Private-PIPE Rounds

Chart: Distribution of Biopharma Private-PIPE Rounds

New analysis from Collabrity, the Biotech Private-PIPE Company™, reveals a decisive trend: in nearly every major private biopharma financing over the past 18 months, company executives—not placement agents or investment banks—led the raise.

Collabrity examined 410 private biopharma financings of $15 million or more—through Seed, Series A-Z, and other private placement financing rounds—closed between January 2024 and June 2025. Private placements in private equity financing rounds that meet these criteria are defined as “Private-PIPEs”. All were drawn from the curated, quality-checked archive of the Collabrity Report which reports on biopharma financings and acquisitions every workday. Public company financings and crossover rounds leading to IPOs were excluded.

The results are striking:

“When it comes to Biopharma Private-PIPEs, it’s Executives 403, Bankers 7.”

• 98% of these financings were completed without the involvement of a placement agent, investment bank, or broker.

• Executives raised $34.4 billion, while bankers accounted for just $0.5 billion.

Debunking Two Myths in Biopharma Fundraising

This analysis gives the lie to two enduring misconceptions:

1. “I only need a placement agent.” In practice, all but a handful of zero-retainer bankers and placement agents closed Biopharma Private-PIPEs during the 18-month study period.

2. “I only need to pay on success.” 98% of successful private biopharma Boards retained proven CXO fundraisers—typically at $50K/month or more for salary + bonus—whose primary responsibility was raising capital.

Successful fundraisers – seasoned C-level executives with strong Private-PIPE track records – are the essential success factor. Collabrity draws executives of the same phenotype, known as Collabrity Executive Advisors (CEAs), from their ranks. The CEAs currently available through Collabrity have collectively raised over $1 billion in Biopharma Private-PIPEs.

Collabrity’s Model: Executive Advisor-Led, Compliantly Structured

Under the supervision of its associated broker-dealer Finalis LLC, Collabrity has pioneered a compliant and collaborative model that empowers elite executive fundraisers to assist with private biopharma capital raises.

Collabrity supports not only biopharma, but also diagnostics, devices, drug delivery, and AI-powered drug development and healthtech companies. The firm is unlocking an estimated $23 billion annual market opportunity in private biopharma capital raises alone.

About the Collabrity Report

The Collabrity Report powers the firm’s insights with curated, high-quality investment data focused exclusively on the biotech sector. It draws from AnNie Qi™, Collabrity’s proprietary AI + natural human intelligence investor database for qualifying investors, updated daily by the firm’s analysts. The Private-PIPE study was derived entirely from these internal, client-exclusive sources.

About Collabrity Inc.

The Biotech Private-PIPE Company™

Collabrity provides full-service fundraising and advisory solutions to private biotechs raising capital. The firm’s innovative model centers on continuity—ensuring that the individuals who assist in raising capital remain accountable for delivering value post-financing. Founder and CEO Christopher Lehman is a 30-year biotech veteran, proven CFO/CBO fundraiser, and FINRA-licensed investment professional (Series 82/79), with 28 transactions totaling over $950 million in announced value.

Media Contact:

Christopher Lehman

Founder & CEO, Collabrity Inc.

Email: chris@collabrity.com

Website: https://collabrity.com

This material has been prepared for information and educational purposes only, and it is not intended to provide, nor should it be relied on for tax, legal, or investment advice. You should consult with your own tax, legal, and financial professionals for your specific situation.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views or opinions of Finalis Securities, LLC.

Securities offered through Finalis Securities LLC Member FINRA/SIPC. Collabrity Inc and Finalis Securities LLC are separate, unaffliated entities.

PNP Program Partners

Collabrity Report 2025 – 2026,

All Rights Reserved

Send News to Collabrity Report

Please note that we exclusively feature news related to Biotech Financing.

Securities offered through Finalis Securities LLC Member FINRA / SIPC. Collabrity Inc. is not a registered broker-dealer, and Finalis Securities LLC and Collabrity Inc. are separate, unaffiliated entities. Finalis Privacy Policy | Finalis Business Continuity Plan | FINRA BrokerCheck